This transaction results in the bank’s assets decreasing by $1,000 and its liabilities decreasing by $1,000. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Nevertheless, on 5 June, when the bank pays the check, the difference will cease to exist.

Step 1 – Find the deposits in transit:

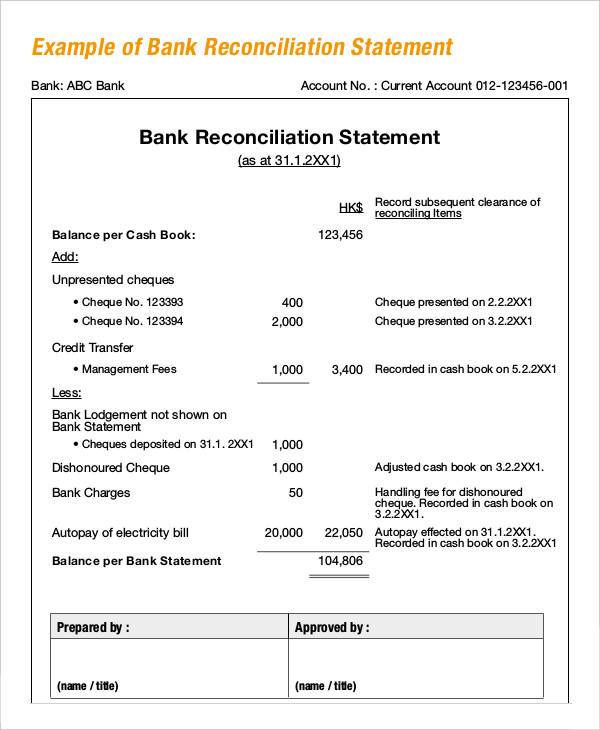

Common errors include entering an incorrect amount or omitting an amount from the bank statement. These miscalculations can also occur on the business’s financial records. See whether adjusted balance of your accounting record is equal to the adjusted balance in your bank statement. Deduct from the bank statement balance the proceeds of any check that you have issued and entered in your accounting record but have not been presented to paid by the bank. Add to the bank statement balance all deposits that are shown by your accounting record but have not been entered in the bank statement. You can do so by comparing the deposits in your accounting record with the deposits shown by your bank statement.

Simplify bank reconciliations with automated expense tracking

Most reconciliation modules allow you to check off outstanding checks and deposits listed on the bank statement. By comparing the two statements, Greg sees that there are $11,500 in checks for four orders of lawnmowers purchased near the end of the month. These checks are in transit, so they haven’t yet been deposited into the company’s bank account. He also finds $500 of bank service fees that hadn’t been included in his financial statement. Once you’ve identified all the items that align between the two records, it’s time to account for any discrepancies.

How confident are you in your long term financial plan?

- For example, you wrote a check for $32, but you recorded it as $23 in your accounting software.

- Bank errors are mistakes made by the bank while creating the bank statement.

- So, to reconcile the amounts, you simply add the additions (interest income) and subtract the subtractions (bank charges and overdraft fees) to reach the bank balance.

Adjust the cash balances in the business account by adding interest or deducting monthly charges and overdraft fees. Bank issues a credit memorandum when it collects a note receivable on behalf of the depositor. Find if there exists any credit memorandum issued by the bank that you have not entered in your accounting record. Generally speaking, bank reconciliations should be completed on a monthly basis to ensure accuracy and timely updates. Typically, each bank account is represented by a separate general ledger account. A reconciliation of this type would be prepared for each bank account and the cash records for that account.

How much will you need each month during retirement?

We reference each entry as E, F, B, D, G, C, or K, as indicated on the right side of the bank reconciliation. Next, we will prepare a bank reconciliation for a hypothetical company by using transactions that are commonly encountered. Once you’ve identified the discrepancies, basic day to day bookkeeping principles make any necessary adjustments. This step ensures your records accurately reflect your financial status. While this will cause a discrepancy in balances at the end of the month, the difference will automatically correct itself once the bank collects the checks.

You need to determine the underlying reasons responsible for any mismatch between balance as per cash book and passbook before you record such changes in your books of accounts. Whereas, credit balance as the cash book indicates an overdraft or the excess amount withdrawn from your bank account over the amount deposited. This is also known as an unfavorable balance as per the cash book or an unfavorable balance as per the passbook. The debit balance as per the cash book refers to the deposits held in the bank, and is the credit balance as per the passbook. Greg’s January financial statement for the company shows $100,000 in cash, but the bank statement shows only $88,000.

This is an important fact because it brings out the status of the bank reconciliation statement. The items therein should be compared to the new bank statement to check if these have since been cleared. Since these items are generally reported to the company before the bank statement date, they seldom appear on a reconciliation. Or if a debtor has paid you via check and you’ve credited the account, but the receivable isn’t reflected yet in the bank statement.

A bank reconciliation is used to detect any errors, catch discrepancies between the two, and provide an accurate picture of the company’s cash position that accounts for funds in transit. You received $800 from Mr. Y (one of your debtors) on January 31, 2021 and recorded it immediately in your accounting records. You then sent this cash to your bank to be deposited into your account but it reached too late to be entered in your bank statement for the month of January. The balance in your accounting record would be different from your bank statement. You issued a check to Mr. X (one of your creditors) for $500 on January 31, 2021 and entered it immediately in your accounting records.